As an insurance agency owner or agent, it's border line essential to consider diversifying the carriers you offer to your clients. Having just one carrier may have its perks, such as simplicity in paperwork and compensation, but it can also have its drawbacks. When tough markets or rateenvironments hit, having only one carrier can be brutal, as clients may need to look elsewhere for coverage. That's why it's important to offer multiple carriers to your clients to provide them with the best protection, company, and price.

Having multiple options for your clients allows you to provide them with the best protection possible. I believe deep down we all know this. Different carriers have different strengths, and by offering a variety of carriers, we can provide our clients with a wider range of coverage options. This way, we can tailor our offerings to suit our clients' specific needs and preferences, providing them with the best possible coverage.

Additionally, by offering multiple carriers, you can cover all different types of risks. We are all familiar with the notion that different carriers have different risk appetites. Different carriers may love or hate various niches, such as insuring high-risk drivers or high-value homes. By having a diverse range of carriers, you can ensure that you have coverage options for any risk that may come your way, allowing you more opportunities to help, and allowing more people in your community to be served.

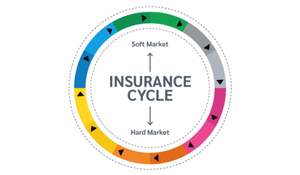

Another important consideration is that carriers make a lot of changes that affect agents and insureds. If you have multiple carriers, you're better prepared to pivot and adjust proactively versus scrambling to find coverage options when a carrier pulls out of the market or makes major changes to their offerings or processes. This can save your clients a lot of hassle and headaches, and help you maintain your agency's stability and reputation.

Moreover, carriers play with compensation plans, which can affect your bottom line as an agent or agency owner. By placing business with multiple carriers, you can ensure that you're placing business where you can make a good living. You'll also have the ability to receive bonuses with multiple carriers, which can help increase your revenue and provide additional incentives for your team.

Having a diversified carrier offering is advantageous for both the agent and the insured. If you lose one carrier to ANYTHING… even be it an oopsie that causes you to lose an appointment, you still have many others to rely on, which means your agency remains strong and healthy. Your clients also benefit from having a wide range of coverage options, and can feel confident that they're getting the best possible coverage for their needs.

The most understated element of diversification of carriers is the freedom to run your business as you see fit. Not being beholden to any one carriers wishes, desires, or current agenda means that you write who and what you wan, work with the types of people you fit in best with, and are beholden to very few in terms of how you market. Compound that with most carriers offering some kind of cost share in your marketing and having a number of carriers can also help you reduce Agency expenses.

Diversifying the carriers you offer is critical for your agency's success. Agents who only offer one may tell you otherwise. They have no experience to the contrary. Asking anyone who has been on both sides of the fence and the evidence is clear.

By offering multiple carriers, you can provide your clients with the best possible protection, company, and price. You can also cover all different types of risks, adjust reactively to carrier changes, and ensure you're placing business where you can make a good living. Ultimately, having a diversified carrier offering is a win-win situation for everyone involved.

.png?width=180&height=65&name=Untitled%20design%20(29).png)