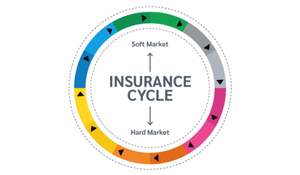

As the insurance market begins to soften, many agents will find themselves in a position of opportunity. The shift from a hard market, where capacity is limited and premiums are high, to a softer market, where more carriers are willing to write business, can bring new opportunities for growth—but only if you’re prepared to capitalize on them. Here are the top 5 ways to prepare your agency to thrive as the market softens.

1. Reevaluate Your Carrier Relationships

When the market softens, more carriers will start offering competitive rates and new products, allowing you to diversify your carrier portfolio. This is the perfect time to reevaluate your existing carrier relationships. Are they still the right fit for your agency? Do they provide competitive rates and value-added services? Or are there new carriers entering the market that may be a better fit for your clients?

Take the time to explore new carrier partnerships, negotiate better contracts, and expand your offerings to ensure you can deliver the best products to your clients.

2. Audit Your Book of Business

In a softer market, competition will increase, and clients will likely begin shopping around for better rates. Be proactive by auditing your book of business now. Identify which clients may be at risk of leaving due to rate sensitivity or policy limitations.

This is your chance to have those conversations early—before your clients start looking elsewhere. Offer them better coverage options or competitive rates from new carriers you’ve onboarded. A comprehensive review of your book will also help you spot cross-selling opportunities, further deepening your relationship with existing clients.

3. Invest in Staff Training and Development

A market shift often brings new products, new carrier guidelines, and new client expectations. Is your staff ready for these changes? As the market softens, investing in your team’s training and development will pay off in spades.

Provide training on new products, underwriting requirements, and technology updates from your carrier partners. Emphasize cross-selling techniques and equip your staff to educate clients on the advantages of new carrier options. When your team is knowledgeable and confident, they will be better equipped to capture new business and retain clients in a competitive environment.

4. Optimize Your Technology and Systems

As carriers ease their underwriting restrictions and new options become available, your agency’s ability to quote and bind coverage quickly will be more important than ever. Now is the time to evaluate your agency’s technology and processes to ensure you’re as efficient as possible.

Are your quoting and binding systems up to date? Do you have a CRM that tracks and organizes client information effectively? Consider upgrading your systems or investing in automation tools that streamline workflows, enhance communication with clients, and reduce administrative burdens. When the market softens, speed and service quality can set you apart from the competition.

5. Double Down on Client Relationships

As the market softens, your competitors will become more aggressive in pursuing your clients. Now, more than ever, is the time to double down on client relationships. Rather than waiting for clients to reach out with questions about their coverage or shopping for better rates, be proactive in your outreach. Regularly communicate with them to review their policies, discuss any new market developments, and identify areas where you can offer enhanced coverage or cost savings.

Take the time to understand each client’s evolving needs and demonstrate your commitment to their long-term financial protection. Personalized service and showing that you genuinely care about their well-being will not only help you retain clients but also position your agency as a trusted advisor during market transitions. Engaged clients are far less likely to be swayed by lower rates alone.

As the market softens, opportunities abound for agencies that are prepared to adapt. By strengthening carrier relationships, auditing your book of business, investing in your staff, optimizing your technology, and doubling down on client relationships, your agency will be well-positioned to thrive. Success in a soft market isn’t just about offering lower rates—it’s about delivering greater value to your clients and staying ahead of the competition. With the right strategy in place, you can turn this market shift into an opportunity for growth and success.

.png?width=180&height=65&name=Untitled%20design%20(29).png)